An animated interpretation of the Tiger Woods Incident.

Tuesday, December 01, 2009

Tuesday, November 24, 2009

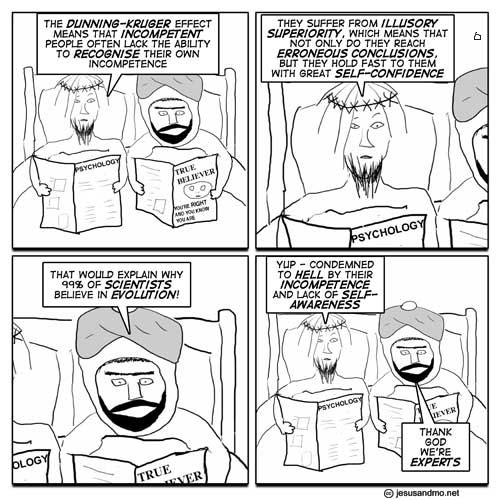

Pure Genius

I saw this last night on Jimmy Fallon and thought it was fukkin' awesome. (oh, and don't mind the 14 sec commercial at the beginning.)

Monday, November 16, 2009

Wednesday, November 04, 2009

Monday, November 02, 2009

Thursday, October 22, 2009

Wednesday, October 14, 2009

Tuesday, October 06, 2009

Like Hiring the Wolves to Watch the Hens or Capitalism at it's Finest

takes 3 minutes to read.

Firms are getting billions, but homeowners still in trouble

By Chris Adams | McClatchy Newspapers

WASHINGTON -- The federal government is engaged in a massive mortgage modification program that's on track to send billions in tax dollars to many of the very companies that judges or regulators have cited in recent years for abusive mortgage practices.

The firms, called mortgage servicers, have been cited for badgering, manipulating or lying to their customers; sticking them with bogus fees, or improperly foreclosing on them.

Mortgage servicers are the middlemen between homeowners and the investors that hold their mortgages, collecting homeowners' checks and disbursing payments for the mortgages, property tax and insurance. They're a necessary player for any modification.

The reliance on such companies points to an ironic paradox for federal regulators: Cleaning up the nation's financial crisis often rewards the firms that helped create the mess. Those Wall Street banks and mortgage servicing companies argue that they're best positioned to repair the damage they've helped cause. In the case of the mortgage program, the firms getting the taxpayers' money are, after all, the firms that control the troubled mortgages.

To make matters worse, the Government Accountability Office, Congress' watchdog, has said that the Treasury Department hasn't done enough to oversee the companies participating in what's known as the Home Affordable Modification Program, which emerged from the bank bailout bill Congress passed last fall.

The modification program has been slow to get off the ground. Since it began this spring, only 12 percent of a potential 3 million delinquent mortgages have begun the process of being reworked, or put into "a trial modification," according to Treasury Department data through August, the most recent available.

"We've consistently been behind this problem," said Mark Pearce, North Carolina's chief deputy commissioner of banks, who works with a state-level group of attorneys general from across the country. "Two years ago, maybe some were caught by surprise. But we still haven't gotten to a point where the servicers have demonstrated an ability to handle the problem."

Although it's early in the Treasury Department's program, housing advocates say the servicer industry for years has resisted helping customers with modifications. Donna and Ronnie Fruia, of Troutman, N.C., learned firsthand how difficult it can be.

The couple was in the midst of a series of health crises, and three members of the family — the couple's son, Donna's mother and Ronnie — were in the hospital.

It was then that Donna got an urgent call that somebody from her mortgage company, CitiFinancial, had just showed up in her husband's hospital room, where he was recovering from a stroke.

"They said, 'Some guy's in there aggravating him,'" she said.

"At the time, I couldn't even really talk that good," Ronnie said. "But he wanted me to sign a bunch of papers."

The Fruias had been trying to get a mortgage modification from CitiFinancial. The company, however, was pushing the Fruias to accept a modification that wouldn't have cut their interest rate, they said.

Only after the episode in the hospital room and the involvement of state regulators did CitiFinancial cut the mortgage's interest rate from 11.5 percent to 5 percent, lowering their monthly payment from $985 to $602. The process took from the start of the year until July.

"They were the perfect candidate for someone with a subprime rate getting a modification," said Henrietta Thompson, who as housing coordinator for United Family Services, a United Way-funded organization in Charlotte, helped the Fruias. "I know if the banking commissioner hadn't gotten involved, it wouldn't have happened."

While CitiFinancial, a unit of Citigroup Inc. — one of the largest recipients of TARP bailout funds — said it couldn't talk about specific customers, it's "pleased" that the case was resolved.

In 2007, an assistant attorney general in Iowa, Patrick Madigan, analyzed the looming mortgage meltdown and found that mortgage service companies have a "highly automated process, spending as little time as possible on an individual loan and preferably no time actually talking to the customer."

"Too many homeowners face foreclosure without receiving any meaningful assistance by their mortgage servicer, a reality that is growing worse rather than better," said a report from the State Foreclosure Prevention Working Group.

Under the Treasury Department's mortgage modification program, three parties can participate: the company that owns the loan, the company that services the loan, and the homeowner. All get a portion of the more than $20 billion that the federal government currently estimates it could spend to keep homes out of foreclosure.

While the Treasury said it's necessary to take in as many mortgage service companies as possible, the GAO found that the department wasn't doing enough to monitor the process.

In a July report, the GAO said that the department had "significant gaps in its oversight structure," and was short-staffed in the office monitoring the modification program. As of July — eight months into the program — the Treasury had filled fewer than half the positions in a key modification office. (Many of those jobs have since been filled, the department said.)

Beyond that, the government had conducted "readiness reviews" of only seven of 27 mortgage servicers the GAO examined; no more were planned. The reviews only included interviews with senior executives — and the information gathered wasn't verified.

"Treasury cannot identify, assess and address risks associated with servicers that lack the capacity to fulfill all program requirements," the GAO said.

Several companies in the Treasury program have been cited by judges or regulators for having engaged in improper behavior with their customers.

They include Select Portfolio Servicing Inc., a Utah-based company formerly known as Fairbanks Capital Corp.; Countrywide Home Loans Inc., now a unit of Bank of America Corp.; Carrington Mortgage Services LLC, based in California; Saxon Mortgage Services Inc., a unit of Morgan Stanley; EMC Mortgage Corp., now a subsidiary of J.P. Morgan Chase & Co.; and Green Tree Servicing, a Minnesota company.

Ocwen Financial Corp., a Florida-based company that services more than 300,000 mortgages nationwide, could receive more than $200 million in TARP payments.

"Ocwen has screwed up my finances so bad you can't believe it," said Brad Rhoton, whose rental properties in the Houston suburbs are part of a nationwide lawsuit against Ocwen. "It's been the most maddening process you can imagine."

Rhoton's lawsuit charges that Ocwen constantly misapplied Rhoton's mortgage payments and tacked on unnecessary fees and insurance, causing his accounts to fall behind.

Over the years, Ocwen has lost other lawsuits and has been slapped down by a federal judge for its conduct.

In one Texas bankruptcy case, for example, a federal judge blasted Ocwen after it tried to pass the cost of a $1,000 sanction onto the customer it was cited for mistreating. When the judge found out, he said, "Ocwen's course of conduct in this proceeding bordered on the outrageous." He fined the company an additional $27,500.

The case was far from isolated, however. A jury in Galveston, Texas, ordered the company to pay $11.5 million, and one down the coast in Corpus Christi ordered it to pay $3 million for unfairly foreclosing on homeowners (both cases were then settled in the appeals process for undisclosed amounts).

In both cases, the plaintiffs were on the edge financially, and so when Ocwen added extra fees to their accounts. they quickly fell behind.

That was part of their strategy, plaintiffs' attorneys said. One of the key witnesses before both juries was a former Ocwen account officer who said the company trained its sights on customers who had substantial equity in their homes. In those cases, the company had the most to gain if customers lost their homes in foreclosure.

"We didn't treat the people very well, but the money was pretty good," the former account officer, Ron Davis, testified during one of the trials. (Davis couldn't be reached for further comment.)

The motive, he said, was simple: force people into foreclosure as a way to earn higher bonuses.

"We would call the customers and ask them what bridge they were going to live under," Davis testified.

Firms are getting billions, but homeowners still in trouble

By Chris Adams | McClatchy Newspapers

WASHINGTON -- The federal government is engaged in a massive mortgage modification program that's on track to send billions in tax dollars to many of the very companies that judges or regulators have cited in recent years for abusive mortgage practices.

The firms, called mortgage servicers, have been cited for badgering, manipulating or lying to their customers; sticking them with bogus fees, or improperly foreclosing on them.

Mortgage servicers are the middlemen between homeowners and the investors that hold their mortgages, collecting homeowners' checks and disbursing payments for the mortgages, property tax and insurance. They're a necessary player for any modification.

The reliance on such companies points to an ironic paradox for federal regulators: Cleaning up the nation's financial crisis often rewards the firms that helped create the mess. Those Wall Street banks and mortgage servicing companies argue that they're best positioned to repair the damage they've helped cause. In the case of the mortgage program, the firms getting the taxpayers' money are, after all, the firms that control the troubled mortgages.

To make matters worse, the Government Accountability Office, Congress' watchdog, has said that the Treasury Department hasn't done enough to oversee the companies participating in what's known as the Home Affordable Modification Program, which emerged from the bank bailout bill Congress passed last fall.

The modification program has been slow to get off the ground. Since it began this spring, only 12 percent of a potential 3 million delinquent mortgages have begun the process of being reworked, or put into "a trial modification," according to Treasury Department data through August, the most recent available.

"We've consistently been behind this problem," said Mark Pearce, North Carolina's chief deputy commissioner of banks, who works with a state-level group of attorneys general from across the country. "Two years ago, maybe some were caught by surprise. But we still haven't gotten to a point where the servicers have demonstrated an ability to handle the problem."

Although it's early in the Treasury Department's program, housing advocates say the servicer industry for years has resisted helping customers with modifications. Donna and Ronnie Fruia, of Troutman, N.C., learned firsthand how difficult it can be.

The couple was in the midst of a series of health crises, and three members of the family — the couple's son, Donna's mother and Ronnie — were in the hospital.

It was then that Donna got an urgent call that somebody from her mortgage company, CitiFinancial, had just showed up in her husband's hospital room, where he was recovering from a stroke.

"They said, 'Some guy's in there aggravating him,'" she said.

"At the time, I couldn't even really talk that good," Ronnie said. "But he wanted me to sign a bunch of papers."

The Fruias had been trying to get a mortgage modification from CitiFinancial. The company, however, was pushing the Fruias to accept a modification that wouldn't have cut their interest rate, they said.

Only after the episode in the hospital room and the involvement of state regulators did CitiFinancial cut the mortgage's interest rate from 11.5 percent to 5 percent, lowering their monthly payment from $985 to $602. The process took from the start of the year until July.

"They were the perfect candidate for someone with a subprime rate getting a modification," said Henrietta Thompson, who as housing coordinator for United Family Services, a United Way-funded organization in Charlotte, helped the Fruias. "I know if the banking commissioner hadn't gotten involved, it wouldn't have happened."

While CitiFinancial, a unit of Citigroup Inc. — one of the largest recipients of TARP bailout funds — said it couldn't talk about specific customers, it's "pleased" that the case was resolved.

In 2007, an assistant attorney general in Iowa, Patrick Madigan, analyzed the looming mortgage meltdown and found that mortgage service companies have a "highly automated process, spending as little time as possible on an individual loan and preferably no time actually talking to the customer."

"Too many homeowners face foreclosure without receiving any meaningful assistance by their mortgage servicer, a reality that is growing worse rather than better," said a report from the State Foreclosure Prevention Working Group.

Under the Treasury Department's mortgage modification program, three parties can participate: the company that owns the loan, the company that services the loan, and the homeowner. All get a portion of the more than $20 billion that the federal government currently estimates it could spend to keep homes out of foreclosure.

While the Treasury said it's necessary to take in as many mortgage service companies as possible, the GAO found that the department wasn't doing enough to monitor the process.

In a July report, the GAO said that the department had "significant gaps in its oversight structure," and was short-staffed in the office monitoring the modification program. As of July — eight months into the program — the Treasury had filled fewer than half the positions in a key modification office. (Many of those jobs have since been filled, the department said.)

Beyond that, the government had conducted "readiness reviews" of only seven of 27 mortgage servicers the GAO examined; no more were planned. The reviews only included interviews with senior executives — and the information gathered wasn't verified.

"Treasury cannot identify, assess and address risks associated with servicers that lack the capacity to fulfill all program requirements," the GAO said.

Several companies in the Treasury program have been cited by judges or regulators for having engaged in improper behavior with their customers.

They include Select Portfolio Servicing Inc., a Utah-based company formerly known as Fairbanks Capital Corp.; Countrywide Home Loans Inc., now a unit of Bank of America Corp.; Carrington Mortgage Services LLC, based in California; Saxon Mortgage Services Inc., a unit of Morgan Stanley; EMC Mortgage Corp., now a subsidiary of J.P. Morgan Chase & Co.; and Green Tree Servicing, a Minnesota company.

Ocwen Financial Corp., a Florida-based company that services more than 300,000 mortgages nationwide, could receive more than $200 million in TARP payments.

"Ocwen has screwed up my finances so bad you can't believe it," said Brad Rhoton, whose rental properties in the Houston suburbs are part of a nationwide lawsuit against Ocwen. "It's been the most maddening process you can imagine."

Rhoton's lawsuit charges that Ocwen constantly misapplied Rhoton's mortgage payments and tacked on unnecessary fees and insurance, causing his accounts to fall behind.

Over the years, Ocwen has lost other lawsuits and has been slapped down by a federal judge for its conduct.

In one Texas bankruptcy case, for example, a federal judge blasted Ocwen after it tried to pass the cost of a $1,000 sanction onto the customer it was cited for mistreating. When the judge found out, he said, "Ocwen's course of conduct in this proceeding bordered on the outrageous." He fined the company an additional $27,500.

The case was far from isolated, however. A jury in Galveston, Texas, ordered the company to pay $11.5 million, and one down the coast in Corpus Christi ordered it to pay $3 million for unfairly foreclosing on homeowners (both cases were then settled in the appeals process for undisclosed amounts).

In both cases, the plaintiffs were on the edge financially, and so when Ocwen added extra fees to their accounts. they quickly fell behind.

That was part of their strategy, plaintiffs' attorneys said. One of the key witnesses before both juries was a former Ocwen account officer who said the company trained its sights on customers who had substantial equity in their homes. In those cases, the company had the most to gain if customers lost their homes in foreclosure.

"We didn't treat the people very well, but the money was pretty good," the former account officer, Ron Davis, testified during one of the trials. (Davis couldn't be reached for further comment.)

The motive, he said, was simple: force people into foreclosure as a way to earn higher bonuses.

"We would call the customers and ask them what bridge they were going to live under," Davis testified.

Friday, September 25, 2009

A Bill Maher New Rule

from huffingtonpost.com

New Rule: If America can't get its act together, it must lose the bald eagle as our symbol and replace it with the YouTube video of the puppy that can't get up. As long as we're pathetic, we might as well act like it's cute. I don't care about the president's birth certificate, I do want to know what happened to "Yes we can." Can we get out of Iraq? No. Afghanistan? No. Fix health care? No. Close Gitmo? No. Cap-and-trade carbon emissions? No. The Obamas have been in Washington for ten months and it seems like the only thing they've gotten is a dog.

Well, I hate to be a nudge, but why has America become a nation that can't make anything bad end, like wars, farm subsidies, our oil addiction, the drug war, useless weapons programs - oh, and there's still 60,000 troops in Germany - and can't make anything good start, like health care reform, immigration reform, rebuilding infrastructure. Even when we address something, the plan can never start until years down the road. Congress's climate change bill mandates a 17% cut in greenhouse gas emissions... by 2020! Fellas, slow down, where's the fire? Oh yeah, it's where I live, engulfing the entire western part of the United States!

We might pass new mileage standards, but even if we do, they wouldn't start until 2016. In that year, our cars of the future will glide along at a breathtaking 35 miles-per-gallon. My goodness, is that even humanly possible? Cars that get 35 miles-per-gallon in just six years? Get your head out of the clouds, you socialist dreamer! "What do we want!? A small improvement! When do we want it!? 2016!"

When it's something for us personally, like a laxative, it has to start working now. My TV remote has a button on it now called "On Demand". You get your ass on my TV screen right now, Jon Cryer, and make me laugh. Now! But when it's something for the survival of the species as a whole, we phase that in slowly.

Folks, we don't need more efficient cars. We need something to replace cars. That's what's wrong with these piddly, too-little-too-late half-measures that pass for "reform" these days. They're not reform, they're just putting off actually solving anything to a later day, when we might by some miracle have, a) leaders with balls, and b) a general populace who can think again. Barack Obama has said, "If we were starting from scratch, then a single-payer system would probably make sense." So let's start from scratch.

Even if they pass the shitty Max Baucus health care bill, it doesn't kick in for 4 years, during which time 175,000 people will die because they're not covered, and about three million will go bankrupt from hospital bills. We have a pretty good idea of the Republican plan for the next three years: Don't let Obama do anything. What kills me is that that's the Democrats' plan, too.

We weren't always like this. Inert. In 1965, Lyndon Johnson signed Medicare into law and 11 months later seniors were receiving benefits. During World War II, virtually overnight FDR had auto companies making tanks and planes only. In one eight year period, America went from JFK's ridiculous dream of landing a man on the moon, to actually landing a man on the moon.

This generation has had eight years to build something at Ground Zero. An office building, a museum, an outlet mall, I don't care anymore. I'm tempted to say that, symbolically, all America can do lately is keep digging a hole, but Ground Zero doesn't represent a hole. It is a hole. America: Home of the Freedom Pit. Ironically, it's spitting distance from Wall Street, where they knock down buildings a different way - through foreclosure.

That's the ultimate sign of our lethargy: millions thrown out of their homes, tossed out of work, lost their life savings, retirements postponed - and they just take it. 30% interest on credit cards? It's a good thing the Supreme Court legalized sodomy a few years ago.

Why can't we get off our back? Is it something in the food? Actually, yes. I found out something interesting researching last week's editorial on how we should be taxing the unhealthy things Americans put into their bodies, like sodas and junk foods and gerbils. Did you know that we eat the same high-fat, high-carb, sugar-laden shit that's served in prisons and in religious cults to keep the subjects in a zombie-like state of lethargic compliance? Why haven't Americans arisen en masse to demand a strong public option? Because "The Bachelor" is on. We're tired and our brain stems hurt from washing down French fries with McDonald's orange drink.

The research is in: high-fat diets makes you lazy and stupid. Rats on an American diet weren't motivated to navigate their maze and once in the maze they made more mistakes. And, instead of exercising on their wheel, they just used it to hang clothes on. Of course we can't ban assault rifles - we're the first generation too lazy to make its own coffee. We're the generation that invented the soft chocolate chip cookie: like a cookie, only not so exhausting to chew. I ask you, if the food we're eating in America isn't making us stupid, how come the people in Carl's Jr. ads never think to put a napkin over their pants?

Read more at: http://www.huffingtonpost.com/bill-maher/new-rule-if-america-cant_b_299383.html

New Rule: If America can't get its act together, it must lose the bald eagle as our symbol and replace it with the YouTube video of the puppy that can't get up. As long as we're pathetic, we might as well act like it's cute. I don't care about the president's birth certificate, I do want to know what happened to "Yes we can." Can we get out of Iraq? No. Afghanistan? No. Fix health care? No. Close Gitmo? No. Cap-and-trade carbon emissions? No. The Obamas have been in Washington for ten months and it seems like the only thing they've gotten is a dog.

Well, I hate to be a nudge, but why has America become a nation that can't make anything bad end, like wars, farm subsidies, our oil addiction, the drug war, useless weapons programs - oh, and there's still 60,000 troops in Germany - and can't make anything good start, like health care reform, immigration reform, rebuilding infrastructure. Even when we address something, the plan can never start until years down the road. Congress's climate change bill mandates a 17% cut in greenhouse gas emissions... by 2020! Fellas, slow down, where's the fire? Oh yeah, it's where I live, engulfing the entire western part of the United States!

We might pass new mileage standards, but even if we do, they wouldn't start until 2016. In that year, our cars of the future will glide along at a breathtaking 35 miles-per-gallon. My goodness, is that even humanly possible? Cars that get 35 miles-per-gallon in just six years? Get your head out of the clouds, you socialist dreamer! "What do we want!? A small improvement! When do we want it!? 2016!"

When it's something for us personally, like a laxative, it has to start working now. My TV remote has a button on it now called "On Demand". You get your ass on my TV screen right now, Jon Cryer, and make me laugh. Now! But when it's something for the survival of the species as a whole, we phase that in slowly.

Folks, we don't need more efficient cars. We need something to replace cars. That's what's wrong with these piddly, too-little-too-late half-measures that pass for "reform" these days. They're not reform, they're just putting off actually solving anything to a later day, when we might by some miracle have, a) leaders with balls, and b) a general populace who can think again. Barack Obama has said, "If we were starting from scratch, then a single-payer system would probably make sense." So let's start from scratch.

Even if they pass the shitty Max Baucus health care bill, it doesn't kick in for 4 years, during which time 175,000 people will die because they're not covered, and about three million will go bankrupt from hospital bills. We have a pretty good idea of the Republican plan for the next three years: Don't let Obama do anything. What kills me is that that's the Democrats' plan, too.

We weren't always like this. Inert. In 1965, Lyndon Johnson signed Medicare into law and 11 months later seniors were receiving benefits. During World War II, virtually overnight FDR had auto companies making tanks and planes only. In one eight year period, America went from JFK's ridiculous dream of landing a man on the moon, to actually landing a man on the moon.

This generation has had eight years to build something at Ground Zero. An office building, a museum, an outlet mall, I don't care anymore. I'm tempted to say that, symbolically, all America can do lately is keep digging a hole, but Ground Zero doesn't represent a hole. It is a hole. America: Home of the Freedom Pit. Ironically, it's spitting distance from Wall Street, where they knock down buildings a different way - through foreclosure.

That's the ultimate sign of our lethargy: millions thrown out of their homes, tossed out of work, lost their life savings, retirements postponed - and they just take it. 30% interest on credit cards? It's a good thing the Supreme Court legalized sodomy a few years ago.

Why can't we get off our back? Is it something in the food? Actually, yes. I found out something interesting researching last week's editorial on how we should be taxing the unhealthy things Americans put into their bodies, like sodas and junk foods and gerbils. Did you know that we eat the same high-fat, high-carb, sugar-laden shit that's served in prisons and in religious cults to keep the subjects in a zombie-like state of lethargic compliance? Why haven't Americans arisen en masse to demand a strong public option? Because "The Bachelor" is on. We're tired and our brain stems hurt from washing down French fries with McDonald's orange drink.

The research is in: high-fat diets makes you lazy and stupid. Rats on an American diet weren't motivated to navigate their maze and once in the maze they made more mistakes. And, instead of exercising on their wheel, they just used it to hang clothes on. Of course we can't ban assault rifles - we're the first generation too lazy to make its own coffee. We're the generation that invented the soft chocolate chip cookie: like a cookie, only not so exhausting to chew. I ask you, if the food we're eating in America isn't making us stupid, how come the people in Carl's Jr. ads never think to put a napkin over their pants?

Read more at: http://www.huffingtonpost.com/bill-maher/new-rule-if-america-cant_b_299383.html

Saturday, September 19, 2009

Sunday, September 13, 2009

Friday, September 04, 2009

Saturday, August 29, 2009

remote control face

check this out. i'm not sure i like the idea of someone being able to remote control my face so precisely. the dude in the top right does his best not to laugh through most of the clip.

Monday, August 24, 2009

Friday, August 21, 2009

Wednesday, August 19, 2009

Saturday, August 15, 2009

Tuesday, August 11, 2009

Drunk C Wants to Play XBox

I picked up Tiger 10 a few weeks ago and convinced Big C and T to pick it up also. So we've gotten in to the habit of getting drunk and playing "one-ball" on Friday and/or Saturday nights. Last Friday afternoon, per protocol, I get a text message from Big C (also sent to T) setting up a "date" to play XBox later in the evening. I accepted, but Friday evening around 7-ish, Jackie and I decided to go get dinner. I sent a message that I would be home by 9 and we'd play then. Big mistake.

Big C and T had already started drinking and were playing 1 vs. 100 while waiting for me to join them for some Tiger. However, dinner ran later than expected and we also stopped at Meijer to pick up some groceries before going home. Long story short, I didn't make it home 'til 10:30. However, Big C, not being one to let my tardiness go unnoticed, decided to leave me a few drunken voicemails.

The first was promptly at 9PM, my original time to return home from dinner. He then called back at 9:30, at which time I did answer the phone and DID explain to him that I was at Meijer and would be home shortly. He was obviously drunk when I talked to him, but I was certainly enjoying the conversation. Then again, he called back at 10:01 PM to leave another voicemail 'cause I had not yet met them online to play XBox. I find it interesting to note that, while apparently drunk in his first voicemail, he is exponentially drunker in his second, only one hour later. He rambles about jerking each other off in the circle of trust.

Gotta love Big C. And you gotta love the fact that I was sober and have the technology to save and post my voicemails to the web. Enjoy...

Big C and T had already started drinking and were playing 1 vs. 100 while waiting for me to join them for some Tiger. However, dinner ran later than expected and we also stopped at Meijer to pick up some groceries before going home. Long story short, I didn't make it home 'til 10:30. However, Big C, not being one to let my tardiness go unnoticed, decided to leave me a few drunken voicemails.

The first was promptly at 9PM, my original time to return home from dinner. He then called back at 9:30, at which time I did answer the phone and DID explain to him that I was at Meijer and would be home shortly. He was obviously drunk when I talked to him, but I was certainly enjoying the conversation. Then again, he called back at 10:01 PM to leave another voicemail 'cause I had not yet met them online to play XBox. I find it interesting to note that, while apparently drunk in his first voicemail, he is exponentially drunker in his second, only one hour later. He rambles about jerking each other off in the circle of trust.

Gotta love Big C. And you gotta love the fact that I was sober and have the technology to save and post my voicemails to the web. Enjoy...

Sunday, August 09, 2009

Tuesday, July 28, 2009

Saturday, July 25, 2009

I Didn't Know a Chorus Could Do That...

The rain effect is simply freakin' amazing! ...especially when the thunder kicks in. And how about that white-bread beat box?

Friday, July 24, 2009

Thursday, July 23, 2009

never gonna give up your teen spirit

i've never really gotten into the mash-up thing, but i had to watch this since i'm a big nirvana fan. i didn't realize rick astley was so grunge. pretty awesome.

Monday, July 20, 2009

Wednesday, July 15, 2009

Janet Tavakoli is...

president of Chicago-based Tavakoli Structured Finance. Her company is a consulting firm for institutions and institutional investors on derivatives, the securitization of assets, and mergers and acquisitions. Her firm has done work for investment banks. Here is her take on the destruction of our economy for personal greed:

Goldman Sachs Group Inc. announced record earnings Tuesday of $3.44 billion for the second quarter of 2009.

Goldman's stock price leapt 77 percent for the first half of 2009, and closed Tuesday at $149.66 a share.

Without an ongoing series of front- and backdoor bailouts financed by U.S. taxpayers, most of Goldman's record profits would not have been possible.

In April 2009, Goldman Sachs' CEO, Lloyd Blankfein, who received record salary and bonus compensation of $68.5 million in 2007, said that bonus decisions made before the credit crisis looked "self-serving and greedy in hindsight." Now, they look self-serving and greedy with foresight.

Goldman set aside $11.4 billion for employee compensation and benefits, up 33 percent from last year. That's enough to pay each employee more than $390,000, just for the first six months of this year.

In June, Goldman bought back its preferred shares, repaying $10 billion it received from the government's Troubled Asset Relief Program, or TARP, and setting it free of limits on executive compensation and dividends.

Don't Miss

But pay is not the key issue. U.S. taxpayers deserve a large cut of the profits, not the chump change -- less than a half-billion dollars -- they got from preferred shares in the company and the relatively small amount they could get from warrants in its stock.

U.S. taxpayers should insist that a large part of Goldman's revenues and profits belong to the American public. TARP money was just part of a series of bailouts and concessions that allowed Goldman to prosper at the expense of a flawed regulatory system.

In March 2008, Goldman, a primary dealer in Treasury securities, was among the beneficiaries of a massive backdoor bailout by the Federal Reserve Bank. At the time, Henry Paulson, former CEO of Goldman Sachs, was treasury secretary.

In an unprecedented move, the Fed created a Term Securities Lending Facility, or TSLF, that allowed primary dealers like Goldman to give non-government-guaranteed "triple-A" rated assets to the Fed in exchange for loans. The trouble was that everyone knew the triple-A assets were not the safe securities they were advertised to be. Many were backed by mortgage loans that were failing at super speed.

The bailout of American International Group, or AIG, ballooned from $85 billion in September 2008 to $182.5 billion. Of that money, $90 billion was funneled as collateral payments to banks that traded with AIG. American taxpayers may never see a dime of their bailout money again, but Goldman saw plenty.

Goldman may be the largest indirect beneficiary of AIG's bailout, receiving $12.9 billion in collateral, including securities lending transactions, from AIG after the government bailed out the insurance company.

The key question is whether Goldman asked AIG to insure products that were as dodgy as the doomed deal from Goldman Sachs Alternative Mortgage Products exposed by Fortune's Allan Sloan in his October 16, 2007, Loeb Award-winning article: "Junk Mortgages Under the Microscope."

If the federal government had not intervened and if AIG had gone into bankruptcy, Goldman probably would not have received its $12.9 billion from AIG. U.S. taxpayers and the American economy are owed some of the bailout money passed directly through AIG to Goldman.

Wall Street firms also reaped trading windfalls when AIG needed to close out its derivative transactions. This was the most lucrative windfall business in the history of the derivatives markets. When AIG left money on the table, it was U.S. taxpayer money.

Goldman Sachs was granted bank holding company status in the fall of 2008. It already had the temporary ability to borrow from the Fed through the TSLF, which would have expired in January 2009. Now it has permanent access to lending from the Fed.

Goldman can now compete with the largest U.S. banks and borrow money at interest rates pushed as close to zero as possible by the Fed. Goldman gets a further benefit: favorable accounting rule changes. In addition, Goldman issued $30 billion of debt with a valuable government guarantee that remains outstanding.

Meanwhile, the American public faces a rising unemployment rate, falling housing prices, rising unemployment, higher local taxes and a dismal economic outlook.

Interested men with reputations and fortunes at stake rode roughshod over public interest. The American public is owed part of the profits Goldman was able to make because of the largesse of our Congress.

Wall Street's "financial meth labs," including Goldman's, massively pumped out bad bonds and credit derivatives that have melted down savings accounts, pension funds, the municipal bond market and the American economy. Risky assets, leverage and fraud led to acute distress in the global financial markets.

The biggest crime on the American economy may go unpunished with no consequences to the perpetrators. The biggest crime was not predatory lending, but predatory securitizations, packages of loans that did not deserve the ratings or prices at the time they were sold. They ballooned what should have been a relatively small problem into a global crisis.

Wall Street owes the American public for its key role in bringing the global economy -- and in particular, the U.S. economy -- to its knees. Goldman is not alone in owing the American public. It is not the worst of all of the Wall Street firms. But among all of Wall Street's offenders, it is the most well-connected, and Goldman was the firm that cleaned up the most as the result of government bailouts.

Saturday, July 11, 2009

dictionaraoke.org

some of these were shite, but cameo's "word up" turned out well. pink floyd's "another brick in the wall", and nine inch nails's "closer" were good too. ah, MIDIs really do bring back the memories. check out the rest here.

Thursday, July 09, 2009

Monday, July 06, 2009

holy SHITE!!!

slow at the beginning but you get to see what tornado force winds can do to a train on the tracks.

Train Versus Killer Tornado - Watch more Funny Videos

Train Versus Killer Tornado - Watch more Funny Videos

Friday, July 03, 2009

Thursday, July 02, 2009

Tuesday, June 30, 2009

probably not PC, but...

hey... it's current events.

from QDB:

Farrah Fawcett dies, and goes to Heaven.

God says to her "You've been such a good sport, I'll let you have one wish."

She wishes for all the children of the world to be safe.

Michael Jackson appears beside her.

God says to Michael "You've also been a good sport for this, you may have a wish as well."

He wishes not to be black in Heaven.

Billy Mays shows up beside him with a bottle of Oxiclean

from QDB:

Tuesday, June 23, 2009

Denmark: 1973

Sunday, June 21, 2009

Friday, June 19, 2009

Thursday, June 18, 2009

Monday, June 08, 2009

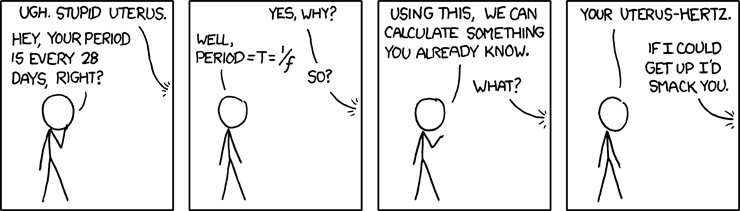

calculating menstruation

Saturday, June 06, 2009

Here's Another One, Marie

Too bad our nation's prison system is too full of non-violent, non-ponzi scheming drug offenders to fill up our prison system with these low-lifes... the real scum of the Earth.

No, I may be mistaken: as someone I know who said to me about the mortgage meltdown (which he used to be a part of the business) and I quote, "It's the niggers fault."

__________________________________

NEW YORK — A former Wall Street broker facing criminal charges linked to the subprime mortgage meltdown has become the target of an international manhunt, federal authorities said Friday.

Prosecutors notified a judge overseeing the case that Julian Tzolov disappeared on May 9 from a Manhattan home where he had been under house arrest since last year after surrendering his passport and posting a $3 million bond. An electronic monitor on his ankle had been removed.

Since then, investigators armed with an arrest warrant have "undertaken an extensive effort to determine Tzolov's whereabouts and apprehend him," prosecutors wrote in court papers.

They asked for a two-month postponement of the Bulgarian-born defendant's trial in Brooklyn as the search for him continues.

Defense attorney Ben Brafman said he lost contact with his client weeks ago.

"We have no idea where he is or what may have happened to him," the lawyer said Friday.

Tzolov, 36, had been set to go to trial on June 29 with former colleague Eric Butler, another former broker for Credit Suisse's private banking division. Both men pleaded not guilty in September to securities fraud, wire fraud and conspiracy charges.

An indictment alleges Tzolov and Butler duped foreign corporate customers into believing that $1 billion in securities being purchased in their accounts were backed by federally guaranteed student loans and were safe like cash.

In reality, the auction rate securities were backed by subprime mortgages, collateralized debt obligations and other high-risk investments, the authorities said. Because of their higher risk, they brought a higher yield and much larger commissions for the brokers.

Tzolov and Butler deceived clients by sending them e-mail confirmations in which the terms "St. Loan" or "Education" were added to names of other types of securities purchased for the customers, prosecutors said.

As a result, customers were stuck holding more than $800 million in securities that were not easily traded and lost their value when the market for the securities began to collapse in August 2007, according to the SEC.

Credit Suisse has said it notified authorities as soon as it became aware of the fraud, and is cooperating with the investigation. The defendants resigned in 2007.

In convicted, each man each faces up to 20 years in prison and a $5 million fine.

No, I may be mistaken: as someone I know who said to me about the mortgage meltdown (which he used to be a part of the business) and I quote, "It's the niggers fault."

__________________________________

NEW YORK — A former Wall Street broker facing criminal charges linked to the subprime mortgage meltdown has become the target of an international manhunt, federal authorities said Friday.

Prosecutors notified a judge overseeing the case that Julian Tzolov disappeared on May 9 from a Manhattan home where he had been under house arrest since last year after surrendering his passport and posting a $3 million bond. An electronic monitor on his ankle had been removed.

Since then, investigators armed with an arrest warrant have "undertaken an extensive effort to determine Tzolov's whereabouts and apprehend him," prosecutors wrote in court papers.

They asked for a two-month postponement of the Bulgarian-born defendant's trial in Brooklyn as the search for him continues.

Defense attorney Ben Brafman said he lost contact with his client weeks ago.

"We have no idea where he is or what may have happened to him," the lawyer said Friday.

Tzolov, 36, had been set to go to trial on June 29 with former colleague Eric Butler, another former broker for Credit Suisse's private banking division. Both men pleaded not guilty in September to securities fraud, wire fraud and conspiracy charges.

An indictment alleges Tzolov and Butler duped foreign corporate customers into believing that $1 billion in securities being purchased in their accounts were backed by federally guaranteed student loans and were safe like cash.

In reality, the auction rate securities were backed by subprime mortgages, collateralized debt obligations and other high-risk investments, the authorities said. Because of their higher risk, they brought a higher yield and much larger commissions for the brokers.

Tzolov and Butler deceived clients by sending them e-mail confirmations in which the terms "St. Loan" or "Education" were added to names of other types of securities purchased for the customers, prosecutors said.

As a result, customers were stuck holding more than $800 million in securities that were not easily traded and lost their value when the market for the securities began to collapse in August 2007, according to the SEC.

Credit Suisse has said it notified authorities as soon as it became aware of the fraud, and is cooperating with the investigation. The defendants resigned in 2007.

In convicted, each man each faces up to 20 years in prison and a $5 million fine.

Thursday, June 04, 2009

No Duh

WASHINGTON — Federal regulators on Thursday charged Angelo Mozilo, the former chief executive of mortgage lender Countrywide Financial Corp., and two other company executives with civil fraud.

The Securities and Exchange Commission's civil lawsuit, filed in federal district court in Los Angeles, also accuses Mozilo of illegal insider trading.

Countrywide was a major player in the subprime mortgage market, the collapse of which in 2007 touched off the financial crisis that has gripped the U.S. and global economies.

Civil fraud charges also were filed against Countrywide's former chief operating officer David Sambol, 49, and ex-chief financial officer Eric Sieracki, 52.

The trio "deliberately misled" Countrywide shareholders, SEC enforcement director Robert Khuzami said at a news conference at agency headquarters. While they painted a picture of robust performance, the real Countrywide was "buckling under the weight" of soured mortgage loans, he added.

Mozilo "was actively taking his own chips off the table" by selling his shares to reap nearly $140 million in illicit profits, Khuzami said.

The Securities and Exchange Commission's civil lawsuit, filed in federal district court in Los Angeles, also accuses Mozilo of illegal insider trading.

Countrywide was a major player in the subprime mortgage market, the collapse of which in 2007 touched off the financial crisis that has gripped the U.S. and global economies.

Civil fraud charges also were filed against Countrywide's former chief operating officer David Sambol, 49, and ex-chief financial officer Eric Sieracki, 52.

The trio "deliberately misled" Countrywide shareholders, SEC enforcement director Robert Khuzami said at a news conference at agency headquarters. While they painted a picture of robust performance, the real Countrywide was "buckling under the weight" of soured mortgage loans, he added.

Mozilo "was actively taking his own chips off the table" by selling his shares to reap nearly $140 million in illicit profits, Khuzami said.

Tuesday, June 02, 2009

Friday, May 29, 2009

Tuesday, May 19, 2009

i gotta see this someday

when i went to australia last year, i spent some time out at sea: diving, snorkeling, swimming, and just generally having a relaxing and enjoyable time. one night after dinner, the crew and guests were on the deck, getting to know each other, and having a few drinks when i looked up and saw more stars at one time than i'd ever seen in my life. it was truly breath-taking.

this is a long-exposure video watching the actual heart of the milky way rise above the horizon. that would be amazing to see.

this is a long-exposure video watching the actual heart of the milky way rise above the horizon. that would be amazing to see.

Galactic Center of Milky Way Rises over Texas Star Party from William Castleman on Vimeo.

Friday, May 15, 2009

The Irony, The Irony

Edmund Andrews, the New York Times Economics Reporter, is having his house foreclosed upon. Doesn't sound like a poor black family who was given a loan by a bank which was forced, at gunpoint, by ACORN and the federal government to loan money to low-income people, does it?

Here are some quotes from Edmund Andrews:

Here are some quotes from Edmund Andrews:

"If there is anybody who should have avoided the mortgage catastrophe, it is me. As an economics reporter for The New York Times, I have been the paper's chief eyes and ears on the Federal Reserve for the past six years. I watched Alan Greenspan and his successor, Ben S. Bernanke, at close range. I wrote several early-warning stories in 2004 about the spike in go-go mortgages. Before that, I had a hand in covering the Asian financial crisis of 1997, the Russia meltdown in 1998, and the dot-com collapse in 2000. I know a lot about the curveballs that the economy can throw at us."

"Take a cue from the bank or Wall Street firm that is now trying to foreclose on your house. Don't apologize. They knew what they were getting into far better than you did. They knew they were in a giant Ponzi scheme, and they certainly should have known it would lead to disaster. They knew the housing bubble was a mirage. They knew their loans were absurd. They knew the triple-A ratings were bogus. They knew, they knew, they knew. They deserve whatever losses come their way."

Friday, May 08, 2009

Equal Rights? My Ass.

Thursday, May 07, 2009

Tuesday, May 05, 2009

Poker in the Front

I was bored today, so I decided to spend 4 hours wasting time designing the official poker chip of the B-Town Boyz.

Sunday, May 03, 2009

Economy Schmeconomy...

Some people have REAL problems. (NOTE: Be sure to watch it 'til the very end.)

Saturday, May 02, 2009

Friday, May 01, 2009

Thursday, April 30, 2009

Tuesday, April 28, 2009

The Final 5

New Rule: If you acted in a FOX sketch comedy show, and your best character was an ugly woman, then you should never be given an Oscar. Let alone allowed to teach youngsters how to sing. As you can tell by the contestants, anybody can get a record deal... even an Actor.

Three weeks left... Thank Science!

Kris: I think Jaimie wanted to "blow" him "away". Your right, Jaimie... He really does "BLOW". I closed my eyes and imagined if I would consider that a good song. He was mediocre... He'll make it to the finals. Not because of talent, but because he is last of the young, small-town, non-gay acting, non-thick-black-rimmed-prick singers left.

Allison: Did Jaimie say he was going to give Allison "The Shocker"? One more year, to almost the day, till she's legal. She just doesn't stand a chance against all the male egos. She needs to dress more goth, or turn Christian clique; or she will maintain her originalness and lose the show.

Matt: Still got the hat. Can cover up his forehead, but can't cover up his talent. He won't get the votes. Who cares how good he may have sung, it doesn't matter. Danny "big glasses and Christian-safe" Gokey and Adam "Diva-Cross-Dressing" Lambert are Personalities... that is what voters want.

Danny: Jaimie is so full of shit. They do not need 4 judges for this show. Get rid of Randy and Kara. I just want a minute to minute-and-a-half Paula ramble and something constructive by Simon. O.K. He finished that out strong. Pretty Good.

Adam: He should have came out in FULL DRAG with this song. I am sure that there are 3 performers like him singing down in The Short North District this Saturday Night... except they are in high-heals, falsies, fabulous hair, and a ton of makeup.

I am so done with the show.

Who will go: Allison

Who will Win: Adam

Three weeks left... Thank Science!

Kris: I think Jaimie wanted to "blow" him "away". Your right, Jaimie... He really does "BLOW". I closed my eyes and imagined if I would consider that a good song. He was mediocre... He'll make it to the finals. Not because of talent, but because he is last of the young, small-town, non-gay acting, non-thick-black-rimmed-prick singers left.

Allison: Did Jaimie say he was going to give Allison "The Shocker"? One more year, to almost the day, till she's legal. She just doesn't stand a chance against all the male egos. She needs to dress more goth, or turn Christian clique; or she will maintain her originalness and lose the show.

Matt: Still got the hat. Can cover up his forehead, but can't cover up his talent. He won't get the votes. Who cares how good he may have sung, it doesn't matter. Danny "big glasses and Christian-safe" Gokey and Adam "Diva-Cross-Dressing" Lambert are Personalities... that is what voters want.

Danny: Jaimie is so full of shit. They do not need 4 judges for this show. Get rid of Randy and Kara. I just want a minute to minute-and-a-half Paula ramble and something constructive by Simon. O.K. He finished that out strong. Pretty Good.

Adam: He should have came out in FULL DRAG with this song. I am sure that there are 3 performers like him singing down in The Short North District this Saturday Night... except they are in high-heals, falsies, fabulous hair, and a ton of makeup.

I am so done with the show.

Who will go: Allison

Who will Win: Adam

Thursday, April 23, 2009

Never Gonna Give You Up...

...INTERNET PHENOMENOM!

Find out what it is, and why it matters.

Then, check this out. (WARNING: Follow this last link only after you've checked out the first two.)

Find out what it is, and why it matters.

Then, check this out. (WARNING: Follow this last link only after you've checked out the first two.)

Tuesday, April 21, 2009

The Super 6

The Top 6. I sure hope they end the show on time. Matt lives to see another day. Two go tomorrow. Great, to listen to the TWO worst singers tomorrow.

Disco week? You ain't Jive Talkin', they are really going to sing disco?

The Top 6

Lil: look at that ASS!!!! lettin' it all hang out! Let that badonkadonk free!! Singing at Wheeling Island Racetrack and Gaming Resort in 6 months... Lil Rounds. She is Chaka "Gone".

Kris: He should play with more people who have a darker complexion. He did pretty good. I didn't mind it. What is Paula talking about? He likes woman's clothes? Paula is freaking screwed up.

Danny: Cheesy. Cheesy. Cheesy. Twice as Nice 'n Cheesy. All the old ladies are up dancing.

Allison: All she has to do is go more Lady GaGa and teenage girls will vote her the winner. She is real good. America, don't be stupid... keep her over Danny.

Adam: I am anticipating something... Diva-Like. Let's see. He's a man who loves to dress like a woman who is pretending like she is acting like a man. Adam moved Paula to a high emotional state. Paula is so messed up. WTF is up with her?

Matt: I think of the dance scene from Airplane! when I hear this song. I was waiting for him to throw his hat and it fly back at his head. He stayed alive for one more week. America was right last week. Anoop is his only hope now.

Anoop: Anoop! Too pink of a vest, Man! Too non-threatening. Anoop! You shot yourself in the foot! You did yourself in! I was expecting some huge Bollywood dance number with background dancers!

Lil and Anoop are gone.

Adam wins the damn thing.

Disco week? You ain't Jive Talkin', they are really going to sing disco?

The Top 6

Lil: look at that ASS!!!! lettin' it all hang out! Let that badonkadonk free!! Singing at Wheeling Island Racetrack and Gaming Resort in 6 months... Lil Rounds. She is Chaka "Gone".

Kris: He should play with more people who have a darker complexion. He did pretty good. I didn't mind it. What is Paula talking about? He likes woman's clothes? Paula is freaking screwed up.

Danny: Cheesy. Cheesy. Cheesy. Twice as Nice 'n Cheesy. All the old ladies are up dancing.

Allison: All she has to do is go more Lady GaGa and teenage girls will vote her the winner. She is real good. America, don't be stupid... keep her over Danny.

Adam: I am anticipating something... Diva-Like. Let's see. He's a man who loves to dress like a woman who is pretending like she is acting like a man. Adam moved Paula to a high emotional state. Paula is so messed up. WTF is up with her?

Matt: I think of the dance scene from Airplane! when I hear this song. I was waiting for him to throw his hat and it fly back at his head. He stayed alive for one more week. America was right last week. Anoop is his only hope now.

Anoop: Anoop! Too pink of a vest, Man! Too non-threatening. Anoop! You shot yourself in the foot! You did yourself in! I was expecting some huge Bollywood dance number with background dancers!

Lil and Anoop are gone.

Adam wins the damn thing.

Subscribe to:

Posts (Atom)